La inflació dels últims anys ha portat els consumidors a prestar una atenció molt important al preu a l’hora de prendre decisions de compra. I això ha augmentat el nombre de productes i marques de marca privada en promoció a les seves cistelles, dues maneres que els consumidors utilitzen per mitigar l’impacte de la inflació en la seva despesa.

En aquest context, molts CMO estan sota pressió per augmentar la inversió promocional i reduir el preu. Aquesta és una decisió d’alt risc que no s’ha de prendre a la lleugera. Si després de baixar el preu, les vendes no augmenten, la rendibilitat i el valor de la marca es veuran erosionats, i la situació serà encara més difícil per a l’empresa i el CMO.

Abans de prendre aquest tipus de decisió, és imprescindible estar completament segur que la barrera que frena les vendes és realment el preu i cap altra. La manca de consciència, per exemple, té altres solucions sense el risc de rebaixar el preu.

En aquestes situacions, la investigació dels consumidors és imprescindible per garantir que les converses amb les parts interessades i els clients no es basen en conjectures sinó en dades i coneixements sòlids que portin a les decisions correctes.

La investigació Drivers & Barriers

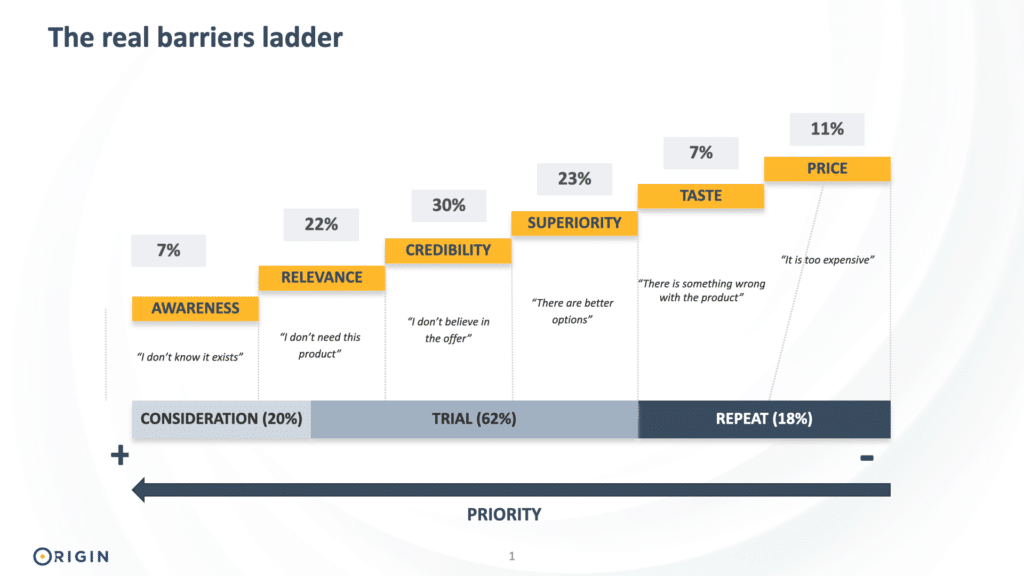

El primer pas és crear una imatge completa i objectiva de les barreres que frenen els compradors. Això es fa amb una investigació específica de Drivers i Barreres. Aquest tipus d’investigació s’adreça als no compradors de la marca i es pregunta per què no han escollit la marca. Potser no coneixen la marca, no està present a la seva botiga habitual o no la consideren adequada. Hi ha molts motius per no comprar una marca i aquest tipus d’investigació quantifica la importància de cadascun.

Algunes de les barreres més comunes per a la compra de productes en una enquesta de Conductors i Barreres són:

- Notorietat Els compradors potencials no coneixen la marca (i, per tant, els serà més difícil considerar-la).

- Rellevància. Quan el producte no és rellevant per al consumidor, no és el que està buscant quan va a la botiga.

- Credibilitat. Si el consumidor no té confiança que el producte ofereix els beneficis que promet.

- Superioritat. El consumidor percep que hi ha altres productes al mercat clarament superiors.

- Prova del producte. Un cop s’ha comprat el producte per primera vegada, ha de satisfer les expectatives del comprador. Sabor, vida útil, eficàcia per fer el que promet, etc…

- Preu. El preu del producte és adequat per permetre la prova i la seva eventual inclusió en el repertori.

Aquest conjunt de barreres s’ha d’adaptar necessàriament a cada sector i producte perquè sigui òptim per a cada cas concret.

Preu a les enquestes de Conductors i Barreres

El problema de la majoria d’aquestes enquestes de conductors i barreres és que el preu sovint està sobrerepresentat en les respostes dels consumidors. I això passa per diversos motius:

- Biaix de percepció del preu. És molt difícil per als consumidors encertar el preu de qualsevol marca si no el veuen. I quan ho veuen, acostumen a considerar-lo car. Al cap i a la fi, a tots ens agradaria pagar menys pels productes que comprem, no? Però quan la marca està al costat d’altres al prestatge, la seva percepció pot ser diferent, ja que poden valorar el preu en relació amb altres opcions.

- Incentiu per influir en el preu a la baixa. Si els consumidors perceben que les seves respostes poden comportar una reducció del preu, tindran un incentiu per considerar el preu com a alt.

- La duplicació de barreres. La majoria dels consumidors identifiquen més de dues barreres per comprar una marca. Per tant, fins i tot si ens afanyem a canviar el preu, és possible que no puguem augmentar la base de compradors, ja que es continuaran frenant per altres barreres. En aquest cas, cal analitzar de manera aïllada la capacitat de mobilització efectiva de cadascuna de les barreres.

Ja és difícil que el consumidor proporcioni informació objectiva sobre els preus. Per tant, en un context d’inflació, és encara més probable que el preu estigui al capdavant del rànquing. Això podria portar a decisions equivocades. Només una anàlisi experta que tingui en compte aquests biaixos ens permetrà obtenir una imatge clara que ens ajudi a prendre les decisions correctes.

Prioritzar barreres

La clau de la capacitat del CMO per gestionar les barreres a la compra de la marca és prioritzar-les i utilitzar el pressupost disponible per treballar-hi progressivament. Amb un pressupost sempre limitat, el CMO hauria de destinar més inversió a aquelles barreres que tenen més probabilitats d’atreure compradors. Les dades ajudaran a prendre les decisions correctes i ajudaran a convèncer l’organització de no desviar recursos per eliminar barreres amb poca capacitat de mobilització.

Per això, quan un consumidor indica diverses barreres, hem de saber discernir quina d’elles és la més important. Si un entrevistat declara que una marca és massa cara, però al mateix temps ens diu que no creu en els beneficis del producte, sembla clar que baixar el preu no ens ajudarà. En aquest cas, el camí ideal seria resoldre la credibilitat dels beneficis del producte i després veure si el preu continua sent una barrera per a la compra.

Trencar barreres amb eficàcia

A Origin Insights hem dut a terme molts projectes d’investigació al llarg dels anys sobre barreres en diferents categories, de manera que tenim una metodologia ben definida i provada que funciona en tres passos:

- Investiguem en profunditat cadascuna de les barreres declarades pel consumidor. No n’hi ha prou amb identificar barreres en una llista sense context. Utilitzem un ampli qüestionari que s’adapta a les respostes del consumidor i aprofundim en els detalls que hi ha darrere de cada barrera per entendre-les millor.

- Analitzem i prioritzem les barreres clau per a la marca. En lloc de confiar directament en les respostes dels consumidors, el nostre algoritme adaptat a cada categoria identifica la barrera prioritària per a cada consumidor i quantifica la importància de cadascun al mercat.

- Amb els resultats creem i construïm l'”escala de barrera real”, un mapa que ens permet visualitzar fàcilment quines barreres són la prioritat i quin volum de compradors serien capaços d’atreure.

Equipat amb l’escala de barreres reals, el CMO podrà utilitzar el pressupost de manera eficaç per aixecar barreres progressivament per tal de maximitzar l’adquisició de compradors i el creixement de la marca.

Vols saber-ne més?